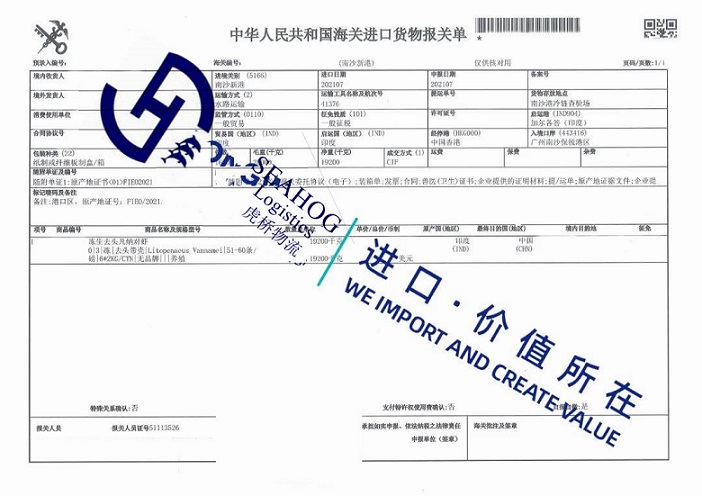

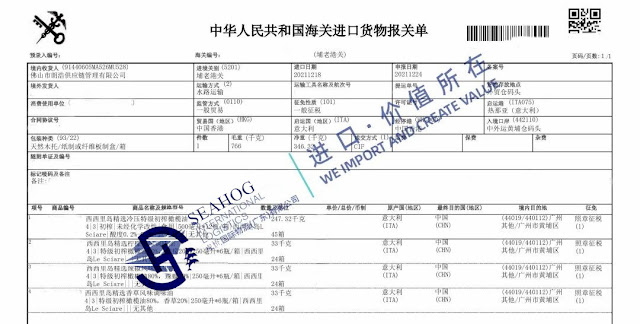

Olive oil is one of the most common vegetable oils that Seahog, a China customs broker, handles. As below is the customs declaration form for an olive oil shipment from Italy that Seahog’s Guangzhou customs broker team helped clear.

The classification of olive oil.

Based on China national standards, pre-packed olive oil is classified into virgin olive oil (physical processed), refined olive oil and blended olive oil.

Virgin olive oil can further be classified to extra virgin, medium-grade Virgin and Virgin olive lamp oil which can not be eaten directly.

The required documents for handling customs clearance of olive oil

Automatic import license, certificate of origin, sanitary certificate, nutrition facts test report, bottling date certificate, sales contract, invoice and packing list.

The import flow

1.The manufacturer, exporter and consignee shall be registered at customs system

2.Apply for automatic import license

3.Put Chinese label on each bottle of olive oil

4.Arrange shipping to China

5.CIQ declaration & customs declaration after shipment arrival

6.Arrange tax payment to customs

7.Inspection & sampling

8.Customs release

9.Issue inspection & quarantine certificate

Chinese label for olive oil

The Chinese label for olive oil shall indicate name of the olive oil, ingredients, country of origin, net weight, storage condition, importer/name, address and contact info, packing list, production date, shelf life, nutrition facts table, content of trans-fatty acids. Chinese label for virgin olive oil shall also indicate the packing year of the olive fruits.

Related Reading:Olive oil is cold pressed from fresh olive fruit. It keeps natural nutritional ingredients as it is not heated or chemical treated. Olive oil is regard as the most suitable oil ever known by far for human being.

Olive oil and olive pomace oil, with a history of several thousand year in Mediterranean countries, are honored as liquid gold, queen of vegetable oil and sweet dew of Mediterranean as its terrific health care and beauty effects and ideal cooking usage.

Seahog Logistics- Since 1997

Guangzhou customs broker, Guangzhou Import Agent, Freight Forwarder, Door to Door Solutions

Contact:Ms Mabel

Mobile/whatsapp:+86-137-6070-0701

Email: 308704459@qq.com

Skype: rosehill-yh

QQ/WeChat: 308704459

Website: http://www.seahog-aw.com/